Which Scheme do you fall under?

There are currently three legislative carbon reduction schemes in the UK, with a fourth potential scheme at draft stage. These are:

- Carbon Reduction Energy Efficiency Scheme (CRC)

- Climate Change Agreement (CCA)

- European Union Emissions Trading Scheme (EU ETS)

- UK Mandatory GHG Reporting for UK Quoted Companies

In addition to the new scheme the Government is also poised to publish new Guidance and a simplification of CRC in November 2012. The legislative landscape is therefore set to change.

Computatis has its finger on the pulse of legislative change. With our cutting-edge software, Computatis has the tools to ensure your organisation becomes compliant, whichever scheme you fall under. Similarly for voluntary reporting, Computatis delivers the tools to help you report at the industry-wide standard (GHG Protocol and ISO 14064).

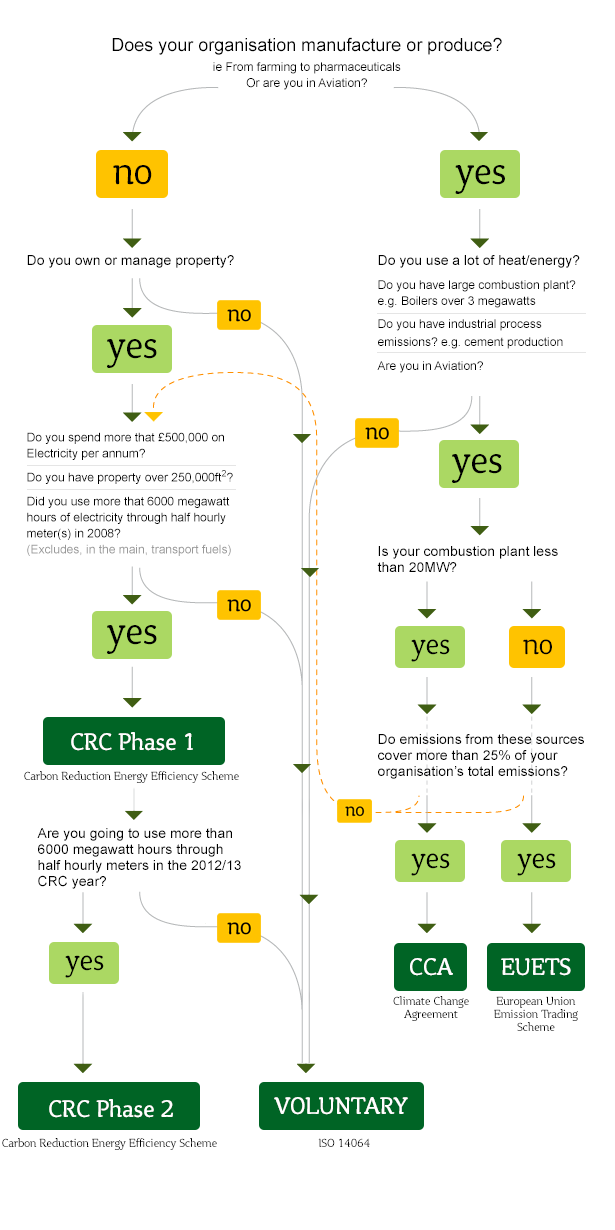

Our flowchart below is a visual aid to determine which Scheme or Agreement you fall under.

Key points at a glance:

- Carbon Reduction Commitment Energy Efficiency Scheme (CRCEES or CRC) covers the large but non-energy intensive organisations, normally associated with property, and include local government organisations and charities.

- UK Mandatory GHG Reporting currently subject to a consultation, this could require all UK quoted companies to report their GHG emissions.

- If your organisation does not fall under any legislation you may still wish to report your Carbon Emissions under a Voluntary basis.

- European Union Emission Trading Scheme (EUETS), mandatory emissions trading scheme covers the biggest carbon emitters in the EU, such as power stations, iron and steel, cement and lime, and glass and ceramics producers.

- Climate Change Agreements (CCA), meanwhile, allow companies in energy intensive sectors, UK only, to receive an 80% discount from the Climate Change Levy charged on all non-domestic energy. The discount is available in return for meeting energy efficiency or carbon saving targets.